Prioritising proactive ESG management to create long-term value.

La Mancha incorporates the principles of responsible investing into its investment philosophy, evaluation and management criteria and encourages the Fund’s portfolio companies to adhere to leading international best practices.

”Utilising the power of financial markets to address sustainability challenges.

Karim NasrManaging Partner & Co-Chief Investment Officer

Principles for Responsible Investment.

PRI were developed by an international group of institutional investors reflecting the increasing relevance of environmental, social and corporate governance issues to investment practices.

La Mancha incorporates the principles of responsible investing into its investment philosophy, evaluation, and asset management criteria.

Principle 1:

We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2:

We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3:

We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4:

We will promote acceptance and implementation of the Principles within the investment industry.

Principle 5:

We will work together to enhance our effectiveness in implementing the Principles.

Principle 6:

We will each report on our activities and progress towards implementing the Principles.

The EU Sustainable Finance Disclosure Regulation (SFDR) & Taxonomy Regulation.

In order to meet its 2050 carbon-neutrality goal, the European Commission has developed a comprehensive policy agenda on sustainable finance. The Sustainable Finance Disclosure Regulation (SFDR) imposes mandatory ESG disclosure obligations for asset managers and other financial markets participants and the Taxonomy Regulation was designed by the EU Commission’s to address “greenwashing”. It lays out guidelines for determining if an activity is environmentally sustainable, including whether the activity contributes to, or does not significantly harm, one or more specified environmental objectives.

The purpose of these regulations is to channel capital flows towards sustainable investment while managing financial risks stemming from Environmental, Social and Governance (ESG) issues. Bringing ESG factors to the forefront as a mandatory part of every investment decision and no longer viewed as ‘nice to have’ consideration in the investment process.

Six environmental objectives are defined by the taxonomy:

- Climate change mitigation

- Climate change adaption

- Sustainable use and protection of water and marine resources

- Transition to a circular economy, waste prevention and recycling

- Pollution prevention and ion control

- Protection of healthy ecosystems

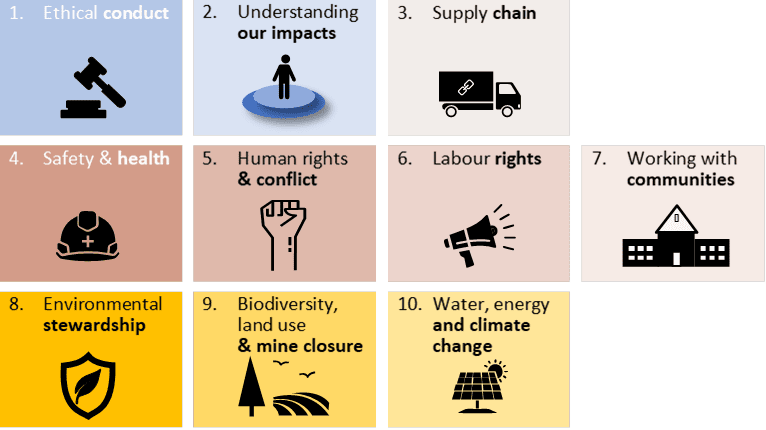

Responsible Gold Mining Principles.

RGMPs are a new framework that set out clear expectations for consumers, investors and the downstream gold supply chain as to what constitutes responsible gold mining. Working with their members, the world’s leading gold mining companies, and collaborating with key industry stakeholders, the World Gold Council has set out the Principles that it believes address key environmental, social and governance issues for the gold mining sector.

Towards Sustainable Mining Initiative.

The Mining Association of Canada’s Towards Sustainable Mining (TSM) standard is a globally recognized sustainability program that supports mining companies in managing key environmental and social risks. The Towards Sustainable Mining (TSM) initiative allows mining companies to turn high-level environmental and social commitments into action on the ground.

At the same time, it provides communities with valuable information on how operations are faring in important areas, such as community outreach, tailings management and biodiversity.

World Bank, International Finance Corporation (IFC) Performance Standards.

IFC’s Performance Standards define companies’ responsibilities for managing their environmental and social risks, as well as a Corporate Governance Methodology, which outlines an approach to evaluate and improve risk management and corporate governance.

IFC’s Performance Standards cover a broad range of ESG topics and issues. Many of them, such as climate change, can affect specific firms, sectors or countries but can also impair the stability of an economy. Alignment with the standards helps companies to identify non-financial risks and opportunities, and developing appropriate strategies to manage or mitigate ESG risks.

UN Global Compact.

La Mancha supports the Ten Principles of the United Nations Global Compact on human rights, labour, environment and anti-corruption. We are committed to making the UN Global Compact and its principles part of our investment strategy, culture and day-to-day operations of our company, and encouraging the Fund’s portfolio companies to do the same to advance the broader development goals of the United Nations, particularly the Sustainable Development Goals.

We believe that by observing the Ten Principles of the UN Global Compact into strategies, policies and procedures, and establishing a culture of integrity, we are laying the foundations for long-term success.

- Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights; and

- Principle 2: make sure that they are not complicit in human rights abuses.

- Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

- Principle 4: the elimination of all forms of forced and compulsory labour;

- Principle 5: the effective abolition of child labour; and

- Principle 6: the elimination of discrimination in respect of employment and occupation.

- Principle 7: Businesses should support a precautionary approach to environmental challenges;

- Principle 8: undertake initiatives to promote greater environmental responsibility; and

- Principle 9: encourage the development and diffusion of environmentally friendly technologies.

- Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery.

The Equator Principles.

The Equator Principles (EP) are intended to serve as a common baseline and risk management framework for financial institutions to identify, assess and manage environmental and social risks when financing Projects. The EP primarily provide a minimum standard for due diligence and monitoring to support responsible risk decision-making.